Changing Jobs? Don’t Forget Your 401(k)

Leaving a job is the primary factor associated with retirement savings “leakage” – in other words, retirement savings lost or spent before retirement.1 By one estimate, 22% of net contributions...

STRATA’s Patrick Hagen Featured: “What Investors Should Know About Private Equity”

Article originally published on TheStreet - Private equity investments via self-directed individual retirement accounts allow investors to move money from publicly traded stocks, bonds or mutual funds into non-correlated options....

9 Key Factors To Consider When Transferring Assets

If you want to move money from one IRA to another IRA, a “transfer” is the easiest method for moving the assets. An IRA-to-IRA “rollover” can also be used to...

Financial Professionals: What Is Your Rollover Advice?

Rollovers from retirement plans to IRAs are the greatest source of dollars flowing into IRAs. Because of the volume of assets involved and the important role these assets play in...

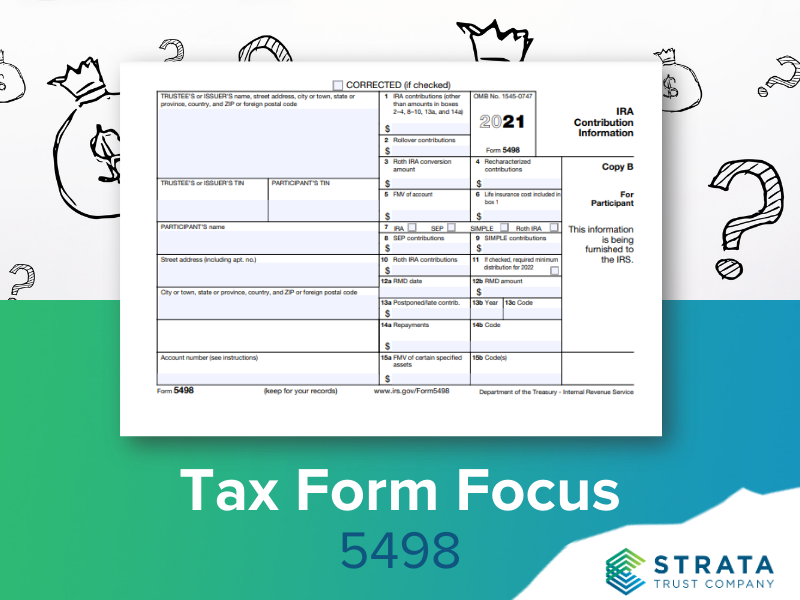

Tax Form Focus: IRS Form 5498

If you own an IRA (including an inherited IRA), you should receive an IRS Form 5498 every year that a reportable event took place. IRA custodians use this form to report...

Update: 2020 IRA Exemptions and Exceptions

With high hopes that 2021 will bring fewer last-minute, emergency changes to tax and IRA-related rules than we saw in 2020, now may be a good time to clear up...