Leaving a job is the primary factor associated with retirement savings “leakage” – in other words, retirement savings lost or spent before retirement.1 By one estimate, 22% of net contributions made by workers ages 20–50 are leaked out of retirement savings each year.1 If you leave your employer and cash out your retirement savings, you will not only lose out on future retirement income, you will also lose some of that money now to taxes and penalties.

If you’re changing jobs, make sure you have a plan for preserving the retirement savings accrued in your former employer’s 401(k) plan. With a little research and planning, you can ensure that all your hard-earned savings continue to grow until you retire.

Three decisions to make

When you stop working for an employer, you can choose to leave your savings in that employer’s 401(k) plan or move your money somewhere else. (If your account balance is under $5,000, your employer can force you out of the plan.) If you choose to move your money, you must decide where and how to move your money. The decision as to where to move your money (for example to an IRA or new employer’s 401(k) plan) may take the most work as you’ll need to gather information and evaluate your options. The second decision is an easy one – moving your money through a direct rollover is the safest route to its new home.

Evaluate your options

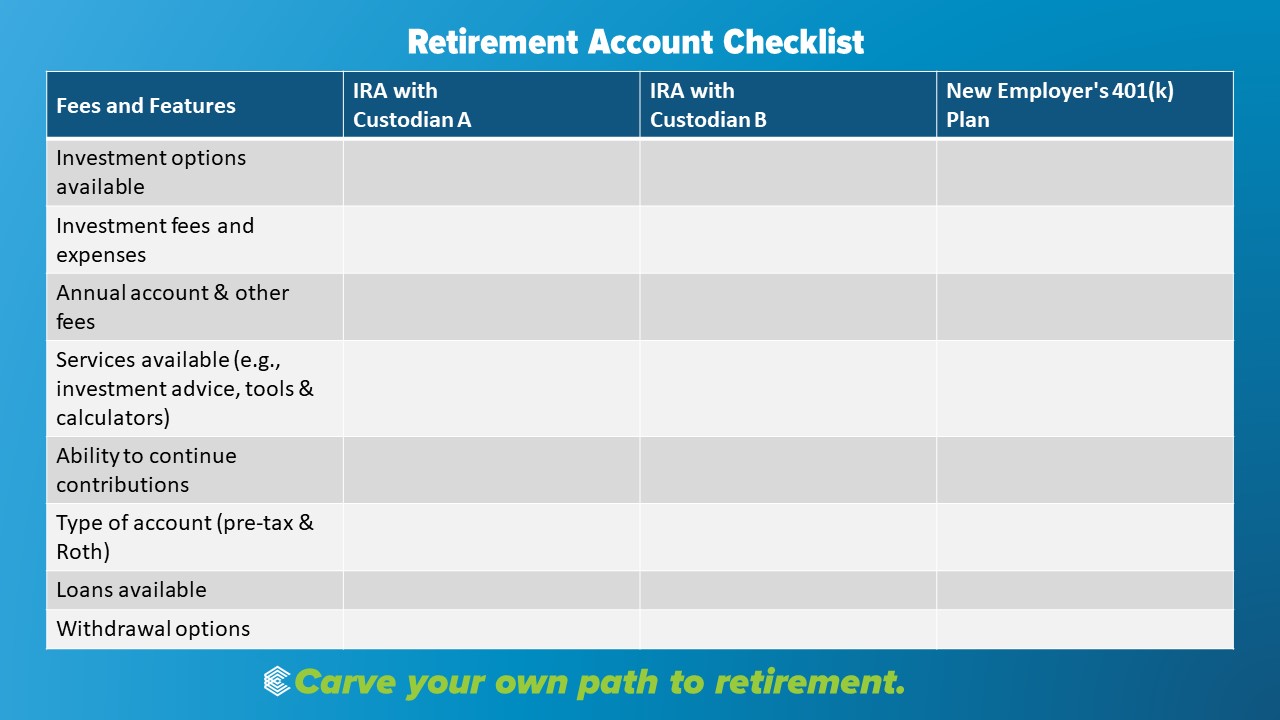

Comparing the fees and features for each retirement account option will help you identify the best location for your nest egg. For example, IRAs are popular retirement savings vehicles for consolidating retirement savings and the investment flexibility they provide to the account owner, while an employer retirement plan may appeal to some individuals because of the option to take a loan from their plan account. Some people base their decision on fees, while others are more concerned about having access to financial advice or retirement planning tools. You may want to engage a financial advisor to help you evaluate your rollover options and identify which features are most important to your retirement income strategy.

Download Your Retirement Account Checklist

The best rollover is a direct rollover.

There are two ways to move money from a 401(k) plan to another 401(k) plan or an IRA. You can conduct an indirect rollover or a direct rollover. Both have the potential for a tax-free movement of assets from one retirement savings vehicle to another, but one involves a lot more risk to get there.

With an indirect rollover, your savings will be paid to you and then you have the responsibility to deposit your savings into an IRA or new employer’s plan. Beware that your plan administrator will withhold 20% of the taxable amount being distributed from your account and remit it to the IRS as a prepayment of income tax you’ll owe on the distribution if you don’t roll it over (many people don’t end up completing the rollover once they have the cash in hand). The 20% withholding amount will be taxable unless you can make up that amount from other savings and deposit it along with the rest of the 401(k) distribution into your IRA or new employer plan. And you have only 60 days to make this happen. Any amounts you don’t roll over into a different retirement savings account will be taxable to you and subject to the 10% early distribution tax if you are younger than 59½.

A direct rollover, on the other hand, ensures that your retirement savings move to your IRA or new employer plan without any tax withholding or taxation. Simply direct your former employer to send your 401(k) plan distribution directly to your IRA or new employer’s plan. You’ll need to provide your plan administrator with the new financial organization’s name, address, and deposit instructions, but you will be assured you will not lose any of your account balance to taxes, penalties or temptation.

For more information on rollovers, see STRATA Trust’s Rolling Over Retirement Savings.

1 Joint Committee on Taxation, Estimating leakage from Retirement Savings Accounts, JCX-20-21, April 26, 2021