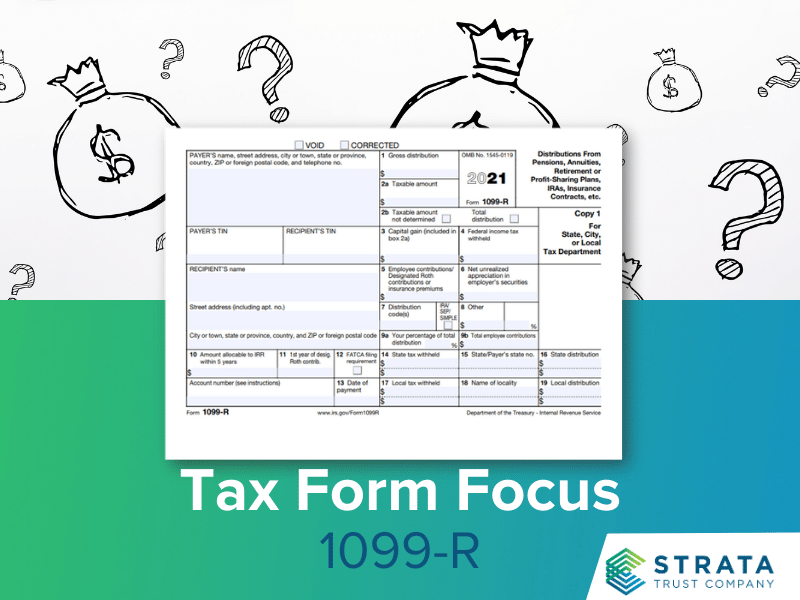

Tax Form Focus: IRS Form 1099-R

As a self-directed IRA owner, you should monitor the tax forms related to IRA investing to ensure you’re receiving the tax advantages available to you. Our tax form focus series...

Is An RMD Due For 2021?

The changes to the required minimum distribution (RMD) rules made by the SECURE Act of 2019 actually took effect in 2020, but all RMDs were waived for 2020 in response...

How Does Fair Market Value Apply To My Self-Directed IRA?

A self-directed IRA allows you the freedom to invest your IRA assets in much more than mutual funds, bonds, and ETFs, which are subject to fluctuations in the stock market....

Tax Advantages for Growing Families

Congratulations if you welcomed a new member to your family this year! Having little ones is expensive, whether you’re paying hospital bills or adoption expenses, or just keeping up with...

STRATA In The Community: CASA of McLennan County

When children enter the foster care system because their home is no longer safe, CASA of McLennan County and its network of invested, compassionate Court Appointed Special Advocate (CASA) volunteers step...

STRATA In The Community: The Shepherd’s Heart

The poverty rate in Central Texas is double the national average and accounts for over 30% of the population. 1 in 4 children under the age of 5 does not...