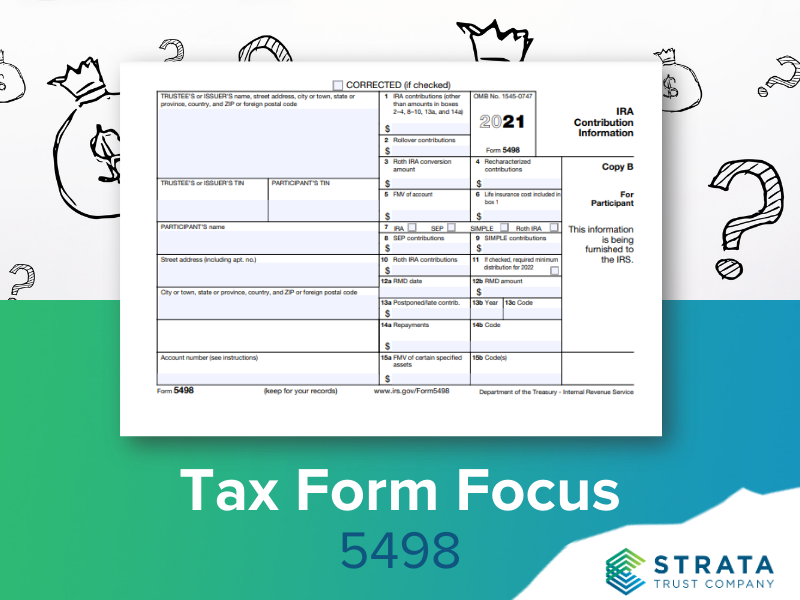

If you own an IRA (including an inherited IRA), you should receive an IRS Form 5498 every year that a reportable event took place. IRA custodians use this form to report IRA contribution activity to the IRS and IRA owners. You may already know how much you have contributed to your IRA for the year, but there is more information on these forms than just annual contribution amounts.

It’s important to review your Form 5498 when you receive it to ensure all the information on the form is correct and matches the amounts you claimed on your tax return. The IRS will be doing the same. Contact your IRA custodian if you believe there is an error on your Form 5498. If there is an error, your IRA custodian will issue a corrected form to both you and the IRS. Be sure to store these forms with your financial files to maintain a record of your IRA contributions and other transactions.

Here are some frequently asked questions and answers about Form 5498.

What information is reported on Form 5498?

In addition to annual contributions made to Traditional and Roth IRAs, Form 5498 reports

In addition to annual contributions made to Traditional and Roth IRAs, Form 5498 reports

- Rollover contributions

- SEP plan employer contributions

- SIMPLE IRA plan employee and employer contributions

- Recharacterized IRA contributions

- Roth IRA conversion contributions

- The fair market value of the IRA as of December 31 of the prior year

- The value of certain types of alternative investments held within the IRA

- Whether a required minimum distribution (RMD) is due for the year (the dollar amount may be included)

- Repayments you have made of any qualified reservist distributions, qualified disaster distributions, coronavirus-related distributions, and qualified childbirth and adoption distributions

When will I receive Form 5498?

Typically, your IRA custodian will send a copy to you and to the IRS by May 31 each year to report activity for the prior tax year. In 2021, the IRA contribution deadline for the 2020 tax year was extended until May 17, 2021 (June 15, 2021, for residents of Texas, Oklahoma, and Louisiana). Because of this extension, the IRS extended the deadline by which IRA custodians must issue Form 5498 to report all contributions received. IRA custodians have until June 30, 2021, to send out 2020 Forms 5498.

I received Form 5498 in January. Will I get another one this year?

IRA custodians may use Form 5498 to satisfy the requirement to provide a fair market value statement and notice of an RMD due for the year – both of which are due to IRA owners by January 31. If you received your Form 5498 early in the year, no further action is necessary on your part unless you believe there is an error on your form or you make an IRA contribution for 2020 between January 1, 2021, and May 17, 2021(or June 15, 2021, for residents of Texas, Oklahoma, and Louisiana). In this case, your IRA custodian will issue an updated Form 5498.

IRA custodians may use Form 5498 to satisfy the requirement to provide a fair market value statement and notice of an RMD due for the year – both of which are due to IRA owners by January 31. If you received your Form 5498 early in the year, no further action is necessary on your part unless you believe there is an error on your form or you make an IRA contribution for 2020 between January 1, 2021, and May 17, 2021(or June 15, 2021, for residents of Texas, Oklahoma, and Louisiana). In this case, your IRA custodian will issue an updated Form 5498.

Do I get a separate Form 5498 for each IRA I own?

You should receive a Form 5498 for each IRA, even if you did not make a contribution to one or more of those IRAs for the year. However, you may not receive a Form 5498 if the IRA custodian is only reporting the fair market value of each investment within an IRA and has provided you with an end-of-year account balance by January 31. If your IRA holds certain hard-to-value investments, however, the value of those investments will be included on Form 5498 along with the fair market value of the entire IRA

You should receive a Form 5498 for each IRA, even if you did not make a contribution to one or more of those IRAs for the year. However, you may not receive a Form 5498 if the IRA custodian is only reporting the fair market value of each investment within an IRA and has provided you with an end-of-year account balance by January 31. If your IRA holds certain hard-to-value investments, however, the value of those investments will be included on Form 5498 along with the fair market value of the entire IRA

Do I need to file Form 5498 with my tax return?

No, Form 5498 is not filed with income tax returns. You may have already filed your tax return by the time you receive Form 5498. But the IRS receives Forms 5498 directly from IRA custodians and may use these forms to crosscheck against the IRA contributions and other transactions reported on federal income tax returns.

I moved money between my IRAs this year, but I never had access to the money. Is that reported to the IRS on Form 5498?

It depends on the type of transaction you completed.

- Transfers directly from one type of IRA to the same type of IRA (e.g., Traditional to Traditional) are not reported on Form 5498. This is true whether you transferred between IRAs held at the same financial organization or different financial organizations.

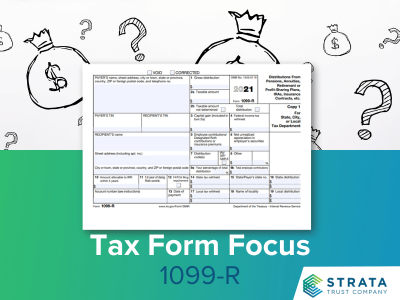

- Conversions of Traditional or SIMPLE IRA assets to a Roth IRA will be reported as a conversion contribution to the Roth IRA, even if the assets were transferred directly between custodians or with the same custodian because a conversion is a taxable event. (You should also receive IRS Form 1099-R showing the money coming out of the first IRA.)

- Recharacterizations of current-year contributions, for example from a Roth IRA to a Traditional IRA, are reported because it could affect your income taxes. The original contribution will be reported on Form 5498 by the IRA custodian receiving the initial contribution and the contribution to the second type of IRA will be reported by the IRA custodian receiving the recharacterized contribution. (You should also receive Form 1099-R showing the money coming out of the first IRA.)

I took money out of my Traditional IRA in 2020 and then put it back in the same IRA within 60 days. Will that show up on Form 5498?

Yes, rollovers into an IRA, whether from an employer plan or another IRA after you had access to the money for 60 days (an indirect rollover), are reported as a distribution on Form 1099-R and as a contribution on Form 5498. If you claimed on your tax return that an IRA distribution was not taxable because you rolled it over to another IRA within 60 days, the IRS should see Form 5498 reporting the rollover contribution. If you moved money from a Traditional IRA to an employer plan like a 401(k) plan, it will not be reported as a contribution on Form 5498 because this form is not used to report contributions to those types of employer plans.

Yes, rollovers into an IRA, whether from an employer plan or another IRA after you had access to the money for 60 days (an indirect rollover), are reported as a distribution on Form 1099-R and as a contribution on Form 5498. If you claimed on your tax return that an IRA distribution was not taxable because you rolled it over to another IRA within 60 days, the IRS should see Form 5498 reporting the rollover contribution. If you moved money from a Traditional IRA to an employer plan like a 401(k) plan, it will not be reported as a contribution on Form 5498 because this form is not used to report contributions to those types of employer plans.

I closed one of my IRAs in 2020. Will I receive IRS Form 5498 for that IRA?

If the value of that IRA was zero as of December 31, you generally will not receive a Form 5498 for the year unless you made contributions to the IRA before it was closed.

More Information:

Additional questions and answers about IRS Form 5498 can be found in our FAQ section.