Don’t let a (tax) savings opportunity pass you by. There is still time to add cash to your self-directed IRA and take advantage of the related tax breaks for 2021. It might be a little confusing with the upcoming holiday falling on tax day, so here is a simple breakdown to keep you on track.

You can deposit your 2021 IRA contributions through your federal income tax-filing deadline for 2021. If your personal tax year follows the calendar year, your federal tax-filing deadline is April 15, unless the IRS extends the deadline (because of a holiday, disaster or other presidentially declared event).

This year, the tax-filing deadline of Friday April 15 falls on the Emancipation Day holiday1 observed in Washington D.C. Because this is considered a legal holiday, the tax-filing and IRA contribution deadline is bumped to the next business day, Monday, April 18, 2022, for residents of D.C. and 48 of the 50 United States. Residents of Maine and Massachusetts have until April 19 to file tax returns and make IRA contributions because these two states observe Patriots’ Day2 on April 18.

Although you may apply for an extension to delay filing your 2021 income tax return until October 17, 2022, IRA contributions must be still be made by the April 18 (or April 19) deadline.

» IRA Contribution Deadline for 2021 « |

||

|---|---|---|

|

Residents of 48 of the ↓ April 18th, 2022 |

Residents of ↓ April 19th, 2022 |

|

If you have already filed your 2021 tax return, you may still make a 2021 IRA contribution up until the federal tax filing deadline, excluding extensions. If you want to take a tax deduction for your 2021 contribution, you will need to file an amended 2021 tax return.

To Make a 2021 Contribution:

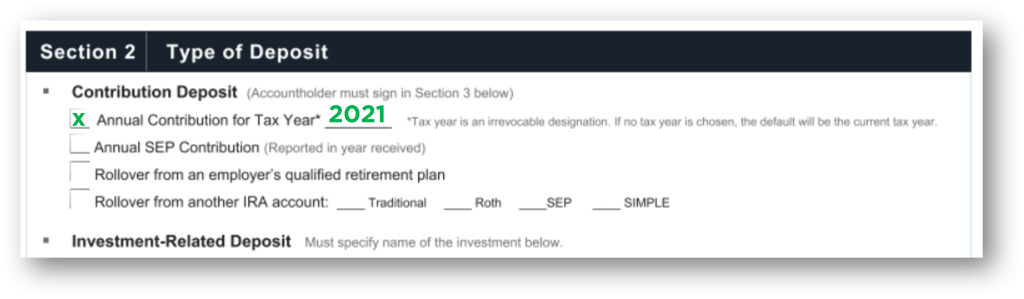

1. Notify Your Custodian of Prior-Year Contributions.

If you make your 2021 IRA contribution after December 31, 2021, you must inform your IRA custodian that your contribution is being made for tax year 2021 so it gets reported accurately. This preserves your annual contribution limit for 2022 and prevents your IRA custodian – and the IRS – from viewing your contributions as a potential excess contribution for 2022.

For STRATA account holders, you can make a 2021 contribution by filling out the Deposit Certification form and filling in Section 2 for the 2021 tax year, as seen below. Payment instructions can be found on the form and in our FAQs.

2. Ensure You Have Not Exceeded the Contribution Limit for 2021.

If you’re eligible to contribute, you can deposit a maximum of $6,000 for 2021 in your Traditional and Roth IRAs. If you’re age 50 or older, you can contribute an extra $1,000 – for a total of $7,000 for 2021 – between your Traditional and Roth IRAs.

A married couple filing a joint tax return can each make the maximum contribution if each is eligible and has an IRA. A couple could contribute $12,000 ($14,000 if both are over age 50) for the 2021 tax year. This could add up to a large tax deduction if contributing to Traditional IRAs, or a big boost in tax-free retirement income if contributing to Roth IRAs.

3. Don’t Forget to Claim a Tax Deduction for a 2021 Traditional IRA Contribution.

Traditional IRA contributions are fully deductible unless you or your spouse are covered by an employer’s retirement plan, such as a 401(k) plan. If you or your spouse are participating in a workplace retirement plan, whether you will be able to take a tax deduction for your Traditional IRA contributions will depend on your modified adjusted gross income (MAGI).

- If you are married, filing a joint tax return, and participated in a retirement plan in 2021, your annual IRA contribution will be fully deductible if your MAGI is $105,000 or less. Your contribution will be partially deductible if your MAGI is between $105,000 and $125,000. If your MAGI is $125,000 or higher, your Traditional IRA contribution will not be deductible.

- If you don’t participate in an employer’s plan but your spouse does, your MAGI must be $198,000 or less to take a full deduction. No deduction is available if your MAGI is $208,000 or more.

- If you are single, your deduction is phased out with MAGI between $66,000–$76,000.

If you don’t qualify to take a deduction, you may still contribute to a Traditional IRA. File IRS Form 8606 with your tax return to track the basis in your IRA, so you won’t have to pay tax on your nondeductible contributions when you take money out of your IRA in the future.

4. Check to See if You Are Eligible to Make a 2021 Roth IRA Contribution.

You may contribute to a Roth IRA for 2021 if you have earned income that falls below certain limits:

- If you are married and filing a joint tax return for 2021, you may make the maximum contribution to a Roth IRA if your MAGI is $198,000 or less. If your MAGI is between $198,000 and $208,000, you may make a partial contribution. If your MAGI is $208,000 or higher, you cannot contribute to a Roth IRA for 2021.

- If you are single, the amount you are eligible to contribute to a Roth IRA is phased out with MAGI between $125,000–$140,000.

Additional Resources:

» Helpful forms for 2021 –

- Instructions for IRS Form 8606 and IRS Form 8606 – Taxpayer files along with federal income taxes to track the basis in your IRA for future withdrawal purposes.

- Deposit Certification Form – Make a one-time contribution to your STRATA IRA; submit this form prior to sending your funds (funding and submission instructions are provided on the form).

» Learn more about 2021 and 2022 IRA contributions and limits –

- IRA Contribution Limits Chart – Overview of 2021 and 2022 contribution limits, deductibility limits, and phase-out ranges for SEP, SIMPLE, Traditional, and Roth IRAs.

- Annual Contributions FAQs – Look through our most commonly asked questions regarding contribution limits, eligibility, and the process to make a 2021 or 2022 contribution to your STRATA IRA.

» Automate payments for your 2022 IRA contributions –

- ACH Contribution Authorization Agreement – Thinking about your 2022 IRA contribution limit? You can set up recurring periodic deposits for your 2022 annual IRA contribution.

» Idle cash in your IRA? –

- Learn about Public Investment options with STRATA.

References:

1 Emancipation Day is a government holiday observed on the weekday nearest April 16 in Washington D.C. This holiday observes the day in 1862 on which President Lincoln signed the District of Columbia Compensated Emancipation Act, which freed more than 3,000 slaves in D.C. eight months before the Emancipation Proclamation liberated slaves in the Confederate states.

2 Patriots’ Day, which is held on the third Monday in April each year, commemorates the opening battles of the American Revolution in 1775.