Self-directed IRAs (SDIRAs) offer valuable tax advantages for your retirement savings. To tap into these benefits and avoid unintended tax consequences, you may need to file certain IRS forms with your federal income tax return each year depending on what you put in or took out of your IRA. STRATA recommends engaging with a tax professional who is knowledgeable about IRAs and how they can impact your tax liabilities.

Below are a few scenarios that will help you decide if you will need additional forms to be filed with your federal income tax return for 2021.

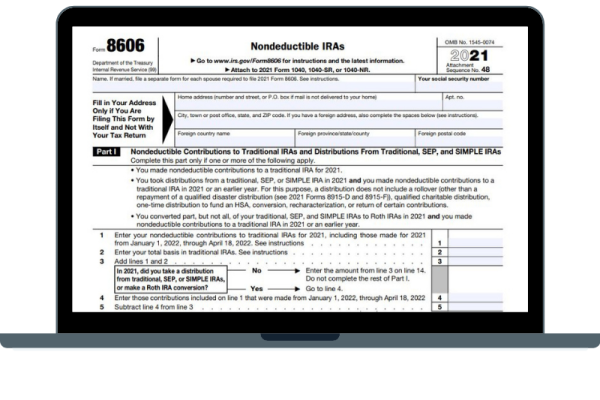

Have You Ever Made Nondeductible or After-Tax Contributions?

IRS Form 8606 – Nondeductible IRAs. Form 8606 is filed with your federal income tax return to track basis going into and out of your Traditional IRAs, so you aren’t taxed twice on the same assets.

IRS Form 8606 – Nondeductible IRAs. Form 8606 is filed with your federal income tax return to track basis going into and out of your Traditional IRAs, so you aren’t taxed twice on the same assets.

If you aren’t eligible to take a tax deduction for your IRA contribution, you are making a contribution with money that has already been taxed. You don’t have to pay tax on it again when you remove it from the IRA, so you want to track that as basis. After-tax assets rolled into the IRA from an employer retirement plan and repayments of qualified disaster, reservist, and coronavirus-related distributions are also tracked as basis. Roth IRA contributions are also made with after-tax dollars and are considered basis.

You generally must file Form 8606 when you:

- Make a nondeductible contribution to a Traditional IRA.

- Repay a qualified disaster or reservist distribution.

- Take a distribution from a traditional, SEP, or SIMPLE IRA and any of your Traditional IRA contains basis.

- Transfer IRA assets that include basis to a former spouse under a divorce decree.

- Convert IRA assets to a Roth IRA.

- Take a distribution from a Roth IRA if you don’t meet the requirements for a tax-free qualified distribution.

- Take a distribution from an inherited IRA that contains basis.

- Take a nonqualified distribution from an inherited Roth IRA.

Are You Subject to an Additional Tax on Your IRA Distribution?

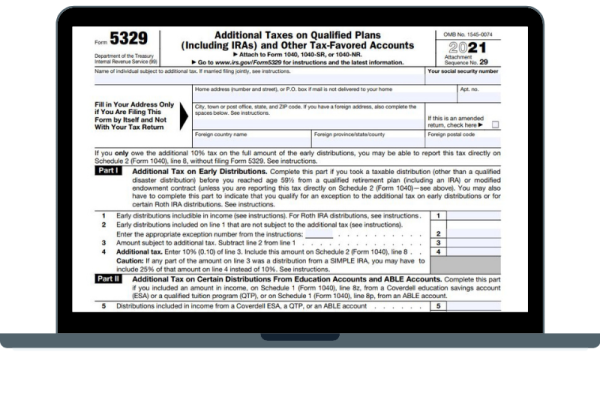

IRS Form 5329 – Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts. You may need to file IRS Form 5329 with your income tax return to pay the additional tax owed on an IRA distribution or explain why you do not owe the additional tax.

IRS Form 5329 – Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts. You may need to file IRS Form 5329 with your income tax return to pay the additional tax owed on an IRA distribution or explain why you do not owe the additional tax.

If you take money from your IRA prior to age 59½, you meet an exception to the 10% early distribution tax (25% for SIMPLE IRAs); your Form 1099-R doesn’t indicate an exception or the exception doesn’t apply to the entire distribution amount, so you generally must file Form 5329 to claim the exception.

You do not have to file Form 5329 to pay the tax if you do not meet an exception and your Form 1099-R includes an IRS code 1 in Box 7.

Form 5329 must also be filed to pay the additional tax owed if you:

- Withdraw an amount you converted to a Roth IRA less than five years ago.

- Fail to timely remove an excess contribution from your IRA.

- Fail to take your required minimum distribution (RMD) by the deadline.

Are You Taking or Repaying a Qualified Disaster or Coronavirus Distribution?

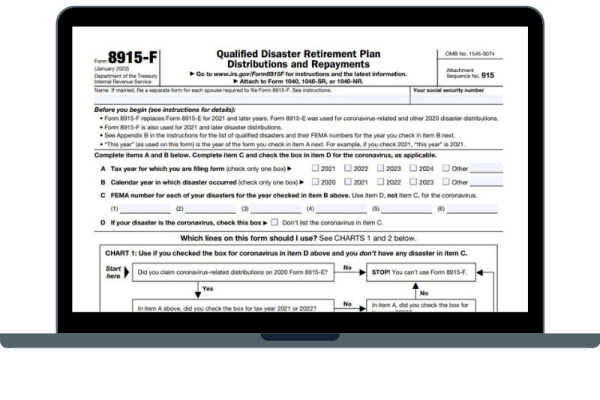

Form 8915-F – Qualified Disaster Retirement Plan Distributions and Repayments. Generally, you may spread the taxation of a qualified disaster distribution over three tax years if you make an election to do so in the year you take the distribution. The election is made using Form 8915-F. This form replaces documents used to report disaster distributions in prior years. Form 8915-F should be filed each year you receive income or make a repayment of qualified disaster distributions. You may need to file Form 8915-F with your 2021 tax return if you:

Form 8915-F – Qualified Disaster Retirement Plan Distributions and Repayments. Generally, you may spread the taxation of a qualified disaster distribution over three tax years if you make an election to do so in the year you take the distribution. The election is made using Form 8915-F. This form replaces documents used to report disaster distributions in prior years. Form 8915-F should be filed each year you receive income or make a repayment of qualified disaster distributions. You may need to file Form 8915-F with your 2021 tax return if you:

- Took a qualified disaster distribution in 2021.

- Are including a 1/3 portion of a qualified disaster distribution (including a Coronavirus distribution) in taxable income in 2021.

- Made a qualified disaster distribution repayment.

Remember: Tax Forms Are Important

Even if you engage a professional to prepare your tax returns or assist with your IRA transactions, it’s important to understand the purpose of these IRS forms and when they’re required to be filed. You are responsible for making sure your IRA complies with the tax laws to avoid tax-related penalties.

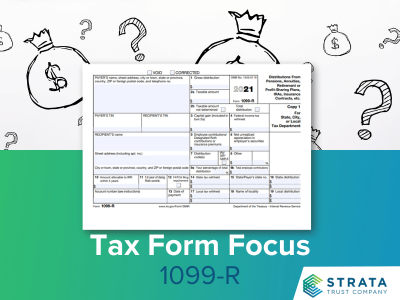

For those looking to learn more about the IRS regulations involved with self-directed IRAs, our FAQ page is full of knowledge on IRS Form 1099-R and IRS Form 5498, as well as several other relevant self-directed IRA tax topics.