After the end of each calendar year, your IRA custodian must provide certain information about your IRA to you and to the IRS. Two of these communications are due by January 31 each year. Watch your mailbox or email for this information. You’ll want to make sure the information is accurate because it can affect your tax liability. If changes are needed, you may need to work with your investment issuer or a third party to obtain updated information and provide it to your IRA custodian.

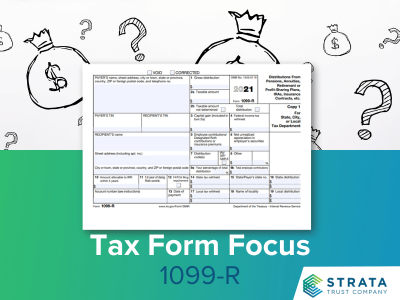

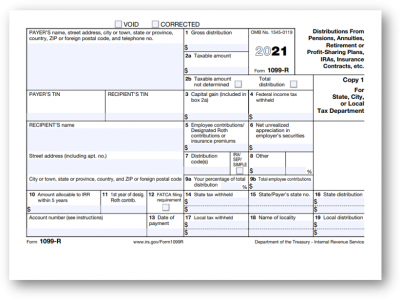

IRS Form 1099-R:

Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

If you withdrew money or assets from an IRA in 2021, the custodian of that IRA must send you a Form 1099-R by January 31, 2022, to report the distribution. Form 1099-R reports the dollar value of the distribution, any federal or state income tax withheld, and whether the asset distributed was one of the types of hard-to-value assets that must be reported on IRS Form 5498. (See below for more information.) The IRS will use the information on Form 1099-R, including the distribution code in Box 7, to determine if the distribution represents taxable income.

If you received more than one distribution in 2021, you will receive more than one Form 1099-R unless all the distributions came from the same IRA for the same reason—for example, you scheduled monthly payments to satisfy your RMD.

If you have information that affects the taxation of your distribution, you will include this with your 2021 tax return. Examples include re-paying a coronavirus distribution, having nondeductible assets in your Traditional IRA, and meeting an exception to the 10% additional tax for distributions before age 59½ that is not reflected on Form 1099-R. Your IRA custodian will be filing your Form 1099-R with the IRS in February or March, so be sure to contact your custodian right away with any questions or changes.

Year-End Fair Market Value

Your IRA custodian will also be providing the December 31 fair market value (FMV) of your IRA by January 31, 2022, generally in a year-end account statement. Self-directed IRAs that are invested in alternative investments that do not have a readily available market value are included in this valuation requirement. As an investor in alternative investments, you must ensure an accurate valuation of your investment is provided to your IRA custodian. STRATA Trust requires that IRA owners obtain the fair market valuation (or good faith estimate) once each year. Additional valuations may be needed any time there is a major change in asset value, and prior to one of the following events:

- You take a distribution of an asset in-kind

- You convert or recharacterize an asset

- You transfer an asset in an account to beneficiaries

Depending on the type of asset held by your IRA, the valuation may either be provided by the investment issuer, or you will be responsible for obtaining a valuation. For this, you may need to engage a qualified independent third party (e.g., a certified real estate appraiser). Documentation supporting the valuation may be required, as well as a notarized signature of the third party providing the valuation.

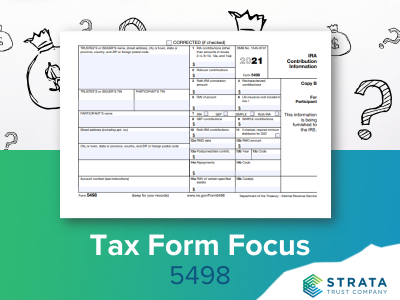

Your IRA custodian must report the year-end value of your IRA to the IRS on Form 5498 in May each year. In addition to reporting the total value, custodians must report the value of certain types of “hard-to-value investments” individually. As described in the instructions of Form 5498, IRA Contribution Information, these types of investments include ownership interests in:

- Real estate

- A corporation, limited liability company, partnership, or trust that is not traded on an established securities market

- Short- or long-term debt that is not traded on an established securities market

- Option contracts or similar products that are not traded on an established option exchange

- Other asset that does not have a readily available fair market value

If STRATA has not received a valuation of your IRA investment by April—either from you or your investment issuer—we will contact you to request a valuation.

If you have questions about investment valuations or year-end reporting, please visit our FAQ library for a wealth of additional resources covering IRS Form1099-R, IRS Form 5498 and FMV topics.