The laws for tax-qualified retirement savings require that IRA owners begin taking at least a minimum amount from their IRAs each year at age 72. If you will be age 72 or older in 2022, you will be required to take a withdrawal from your Traditional, SEP, and SIMPLE IRAs. These are referred to as “required minimum distributions,” or RMDs.

You may want to start planning now for when to take your RMD—and from which investment—including whether you will want to sell the investment first and distribute the cash or distribute the investment itself. Depending on the balance in your IRA, your RMD may affect tax benefits or liabilities that depend on your level of taxable income. Being aware of these things early in the year can help you prepare for additional tax expenses or implement strategies to offset the impact—that’s why STRATA will provide you with the necessary information for your RMD.

RMD Age Requirements:

| Birthdate | RMD Starting Age | First RMD Year | 2022 RMD Due Date | RMD Calculation Based On |

| Jan 1- June 30, 1950 | 70½ | 2021 | December 31, 2022 | Your Dec 31, 2021 IRA Balance and Your Age in 2022 |

| July 1- December 31, 1950 | 72 | 2022 | April 1, 2023 | Your Dec 31, 2021 IRA Balance and Your Age in 2022 |

Annual RMD Notice Deadline

IRA custodians are required to provide an RMD notice to IRA owners for whom they maintained an IRA in the prior year by January 31 of the year for which the RMD is due. The notice may be sent electronically, or it may be delivered along with other statements, such as the fair market value statement, so you’ll want to keep an eye out for it.

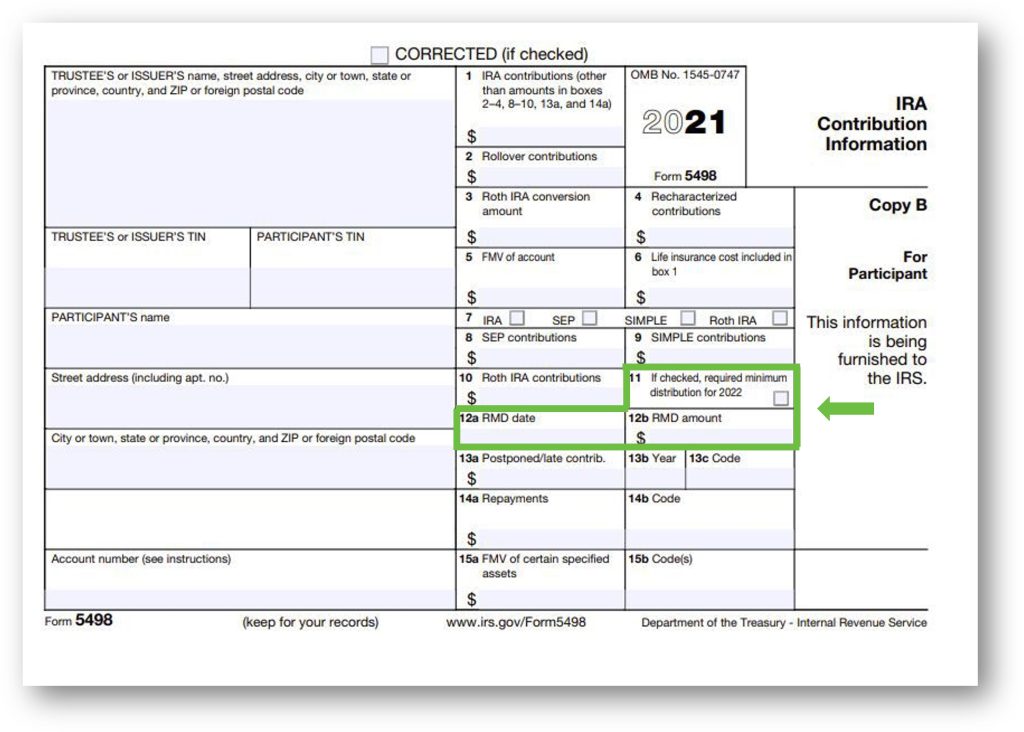

Some custodians use IRS Form 5498 to meet the RMD notice requirement by completing Boxes 11, 12a, and 12b to report the required RMD information. If Form 5498 is used to meet the RMD notice requirement, it must be sent to the IRA owner by January 31.

Review The Information Provided

Your annual notice must inform you that the IRS will be notified of your RMD requirement for the year. IRA custodians notify the IRS when they file IRS Form 5498, which includes a checkbox that identifies IRA owners in RMD status. It is important the account holder reviews the information for accuracy.

- Your RMD Deadline

Once you have begun taking RMDs, you must take a distribution of at least the minimum required amount every year by December 31. For your first RMD year (i.e., the year you turn 72), you may delay taking your first RMD until April 1 of the following year. However, beware that you must also take your second RMD in that following year, which means you will have two taxable distributions for the year if you delay taking your first RMD. This could put you in a higher income tax bracket or otherwise affect whether you are subject to additional tax or restrictions on tax benefits if your income is too high.

2. Your RMD Calculation

IRA custodians may choose from two IRS-prescribed methods for satisfying the RMD notice requirements.

- Include the RMD dollar amount – Some IRA custodians, STRATA included, will incorporate the dollar amount of your RMD, calculated using your IRA’s prior year account balance as of December 31, and your age in the coming year. If you have adjustments to your December 31 balance or your IRA beneficiary is a spouse who is more than 10 years younger, you may want to request a new calculation taking these factors into account.

- Offer to calculate your RMD – Some IRA custodians will include an offer to calculate your RMD upon request rather than providing the actual dollar amount in this notice.

New For 2022

If you have been receiving RMDs for some time, your RMD for 2022 may be slightly smaller than you expected. The IRS has adjusted the life expectancy tables that are used to calculate RMDs to account for longer life expectancies. This adjustment will produce smaller RMDs because your account balance is spread over a greater number of years.

Helpful Planning Tips

- The annual RMD formula will calculate the minimum amount that must be distributed for the year—and you always have the option to take more than the required minimum.

- Any amount you distribute that exceeds the RMD for the year does not count toward next year’s RMD.

- Your RMD may be satisfied with a single payment or multiple payments throughout the year.

- If you have multiple IRAs, you may take the aggregate RMD amount for the year from one IRA or any combination of your IRAs, so long as the RMD amounts are calculated separately for each IRA.

- Roth IRAs are not subject to the RMD requirements until after your death. You cannot satisfy an RMD for a Traditional, SEP, or SIMPLE IRA from your Roth IRA.

- If you don’t take your full RMD by the deadline, you may owe an additional tax equal to 50% of the RMD amount that should have been withdrawn but was left in the IRA.

Common RMD mistakes that are often costly for SDIRA owners include forgetting about their RMD and/or not having cash available to satisfy the RMD in time to meet the annual deadline. Clever tax planning strategies start with being prepared and understanding the impact your RMD will have on your current years’ tax obligation, then working to minimize that impact.

If you feel you should receive an RMD notice but did not, contact your custodian to ensure your account communications preferences are up to date. If you have questions about your RMD notice or RMD calculation, please visit our FAQ section, learn more about IRS Form 5498 or complete a service request and our Client Services Team will assist you.