Have You Put Too Much In Your IRA?

The tax laws don’t limit how much your IRA investments can grow each year or how much you can roll over into your IRA from another tax-qualified account, but they...

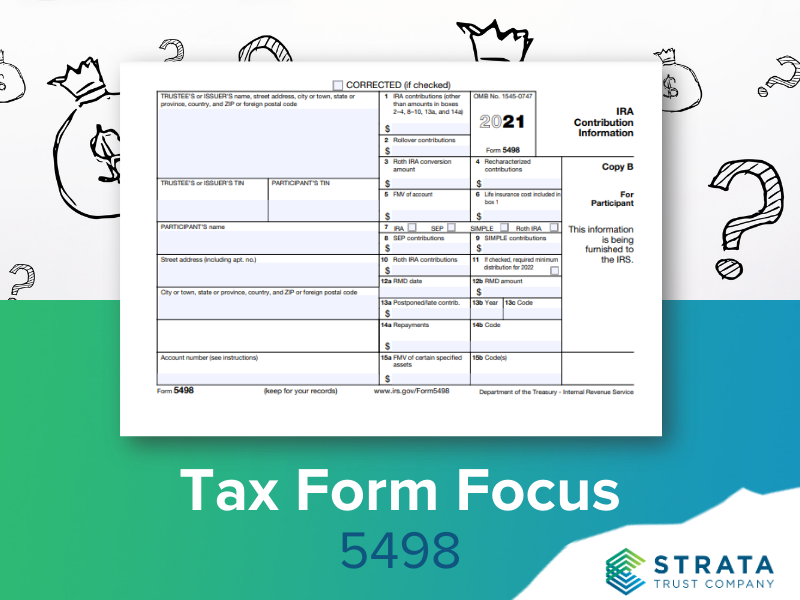

Tax Form Focus: IRS Form 5498

If you own an IRA (including an inherited IRA), you should receive an IRS Form 5498 every year that a reportable event took place. IRA custodians use this form to report...

5 Retirement-Smart Ways to Use Your Tax Refund

If you receive a tax refund this year consider putting that money to work for you instead of spending it. You can save and/or invest that money for your future...

2020 IRS Tax Filing Extension and the Impact on Your IRA

On March 17, 2021, the Treasury Department and the Internal Revenue Service announced an extension of the 2020 tax filing deadline, shifting the normal April 15 deadline to May 17,...

2021 COLA Announcement: Impact on IRAs

SOME IRA LIMITS CHANGE for 2021 Each year, the amount you are permitted to contribute to an IRA or to deduct on your tax return for your contributions can change...