Why Would IRA Investment Income Be Taxed?

One of the benefits of saving for retirement in a self-directed IRA is the deferral of tax on investment growth until distributed from the IRA. Some investment options, like a...

IRS Update: Additional Tax Relief Available

The IRS has recently issued additional tax relief notices to help aid those impacted by recent disaster situations. The IRS notices announce fuel penalty relief and a variety of extensions...

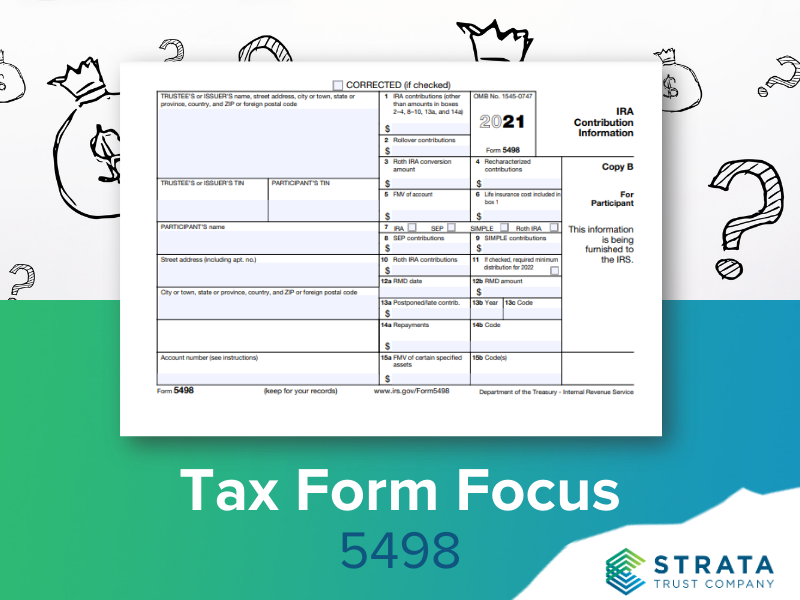

Tax Form Focus: IRS Form 5498

If you own an IRA (including an inherited IRA), you should receive an IRS Form 5498 every year that a reportable event took place. IRA custodians use this form to report...

Update: 2020 IRA Exemptions and Exceptions

With high hopes that 2021 will bring fewer last-minute, emergency changes to tax and IRA-related rules than we saw in 2020, now may be a good time to clear up...

October 15 – Not Just the Last Day to File Your Tax Return

Although October 15 may not stand out as the date of a historic event or a celebrity’s birthday, it is well-known by many as the last day for filing federal...

Do You Want to Pay Taxes Now or Later?

Understanding the Tax Benefits of Traditional & Roth IRAs In addition to saving for retirement, one of the main incentives for saving in an IRA is being able to take...