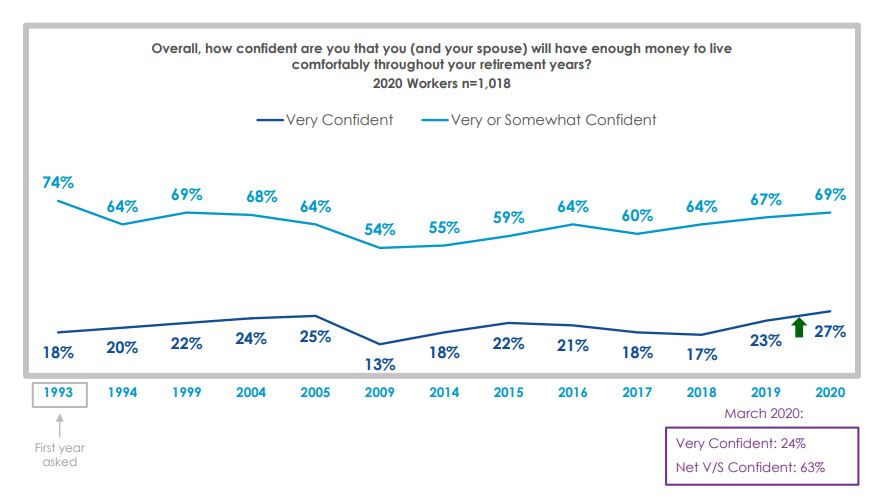

Saving for retirement is a top financial planning goal for most Americans, and savings habits support this sentiment. In fact, the 2020 Retirement Confidence Survey from The Employee Benefit Research Institute (EBRI) found that U.S.-based workers continue to be confident their savings will fund a comfortable retirement1.

This confidence is a bright spot as Americans prepare for their retirement futures, and one thing is for sure: savers want to know that their retirement assets are mitigating risk and growing steadily to meet their long-term objectives. Retirement investors want to put their retirement dollars to work in an effective way. Some turn to the self-directed IRA (SDIRA) as a vehicle to meet their goals and gain more control over their savings.

While 401(k)s, IRAs and other savings vehicles are looked to as commonly known and well understood, SDIRAs offer a number of unique benefits, including asset diversification, tax advantages, the potential for higher return and less exposure to traditional market volatility. Funding a self-directed IRA is easy and can be done in a few ways. Here we outline some of the most common strategies and what investors should know about funding their SDIRA:

• Funding via a direct transfer – Investors can consider a direct transfer of funds from another IRA to a SDIRA. This is non-reportable, meaning it isn’t reported to the IRS, so this is a direct transfer from one IRA to another and the account holder does not come into constructive receipt of the monies. The main advantage of this is there is no tax liability to reporting to the IRS for the distribution.

• Rolling over a workplace retirement account – Commonly, investors hold their retirement savings in a workplace-sponsored account, and investors can consider rolling over a 401(k) or other workplace retirement plan. This often occurs when an individual changes jobs, retires or simply wants to expand the savings options for their retirement funds. It’s worth noting some plans offer an in-service feature, where the participant may be eligible to roll over the 401(k) while they are still employed by the company.

• Funding via ongoing contributions – While initial account balances can be built via rollovers and direct transfers, many savers opt to contribute to their SDIRA on an ongoing basis – some as often as biweekly and others just once a year. For investors using this option, it’s important that they’re aware of contribution limits and regulations.

Why consider a SDIRA? While investing in alternative assets may not be for every investor, for those that are interested, a self-directed IRA is a way for investors to advance on their retirement goals, achieve diversification, realize tax benefits and gain access to an expanded universe of investments.

For investors seeking to diversify their retirement savings strategy, it’s a good idea to speak with your financial advisor to learn more about your options. For more information on using a self-directed IRA to invest in alternative assets, feel free to contact us at [email protected].

1 https://www.ebri.org/docs/default-source/rcs/2020-rcs/2020-rcs-summary-report.pdf?sfvrsn=84bc3d2f_7

Disclaimer: The information provided herein does not, and is not intended to, constitute personalized financial or legal advice. The contents of the article are for general informational purposes only and should not be relied or acted upon without specific professional legal or financial advice, based upon an individual’s situation.