Americans are facing a perfect storm that could impact their retirement savings plans. Many investments, from stocks to cryptocurrencies, have been underperforming. At the same time, inflation has hit record highs and shows no sign of abating, which lowers both spending and savings rates. If wages or investment returns can’t meet or exceed inflation levels, personal savings rates will decline which could cause people to delay retirement.

Many experts suggest that at a minimum we should have at least 20% of our income dedicated to savings – reserving at least 10%-15% of those funds for retirement. This might sound daunting but with employer match programs, tax-advantaged accounts, and other smart investment management strategies it can be done – even in times of high inflation.

Calculate your PSR

A good measure of how much a person is saving is a ratio known as the Personal Savings Rate (PSR). It is essentially the percentage of income left after paying taxes and spending money. A PSR is calculated as Net Savings divided by Total Income and includes money used to fund employer or employee contributions to 401(k) or IRA savings accounts.

A PSR is calculated as Net Savings divided by Total Income and includes money used to fund employer or employee contributions to 401(k) or IRA savings accounts.

- Calculate Net Savings = after-tax money not spent + all retirement contributions (personal and employer)

- Calculate Total Income = income after taxes + employer retirement savings

- Calculate PSR = Net Savings/Total Income

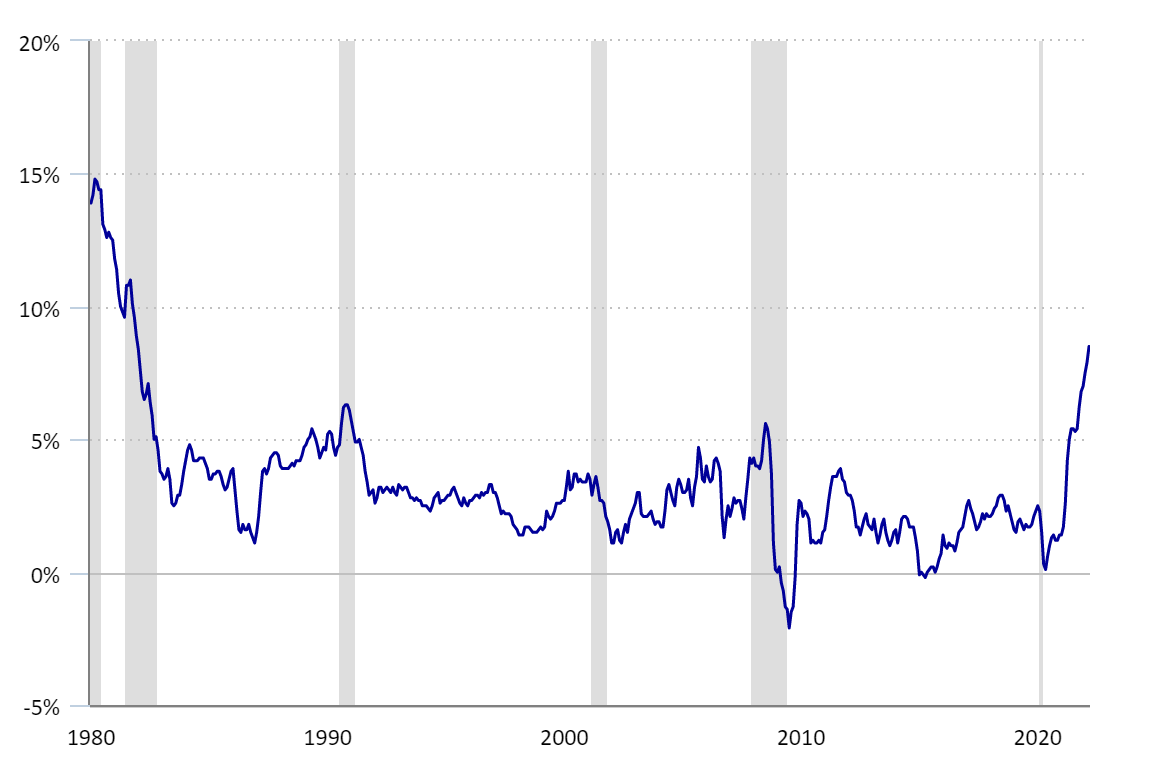

U.S. PERSONAL SAVINGS RATE (1960 – 2022)1

Between 1960 and 2021, the U.S. PSR averaged 8.98%. During the height of the COVID pandemic, the PSR ballooned, reaching almost 35% in the spring of 2020. That was primarily due to COVID-19 support provided by the government, enhanced retirement savings benefits, and reduced monthly spending from people staying home. However, the past year has seen the rate drop from those highs to under 5% and continues to trend downward, with inflation being a major contributor to the PSR accelerated decline.

Inflation & Controls

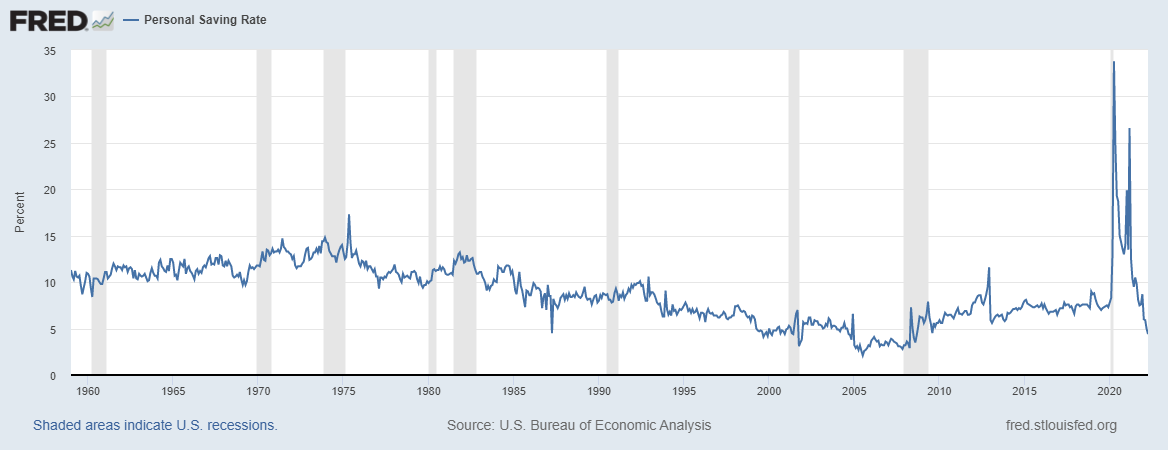

Inflation is gauged by the Consumer Price Index (CPI), which measures the change in prices paid by consumers for goods and services, including food, fuel, and energy. The CPI is based on the prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy for day-to-day living. In the last 12 months up to May, the CPI increased to 8.6%, a 40-year high. For many, the daily impact feels even greater, with groceries up 11.9%, fuel oil 106.7%, gasoline 48.7%, and utilities 16.2%.

12-MONTH PERCENTAGE CHANGE IN CONSUMER PRICE INDEX, (JANUARY 1980 – MARCH 2022)2

The Federal Reserve (“Fed”) is tasked with monitoring and controlling inflation. The Fed aims for a target inflation rate of 2% or less each year. If inflation grows too high, the Fed takes action to slow it down, typically by raising interest rates. Recently, as a result of persistently high inflation, the Fed raised interest rates by 75 basis points with further raises anticipated. That will impact everything from the interest rates on variable mortgages to credit card debt, making the cost of carrying such debt more expensive.

Impact of Inflation on PSR

When inflation causes the costs of everyday goods and services to increase, it is commonly referred to as the erosion of purchasing power. In other words, at 8.6% inflation, if something cost $100 a year ago, it now costs $108.60. As prices for everyday goods and services rise, the amount of disposable income remaining that can be put towards savings decreases.

The same impact is felt on investments. For example, if inflation rises 8.6% and the investments in your IRA return 10%, your net investment return is just 1.4%. If your investment return is less than 8.6%, your net gain is negative. As such, unless total income increases through wages or higher investment returns, an 8.6% inflation rate will cause $8.60 less savings per $100, which lowers a PSR.

If inflation persists without an offset in wages or investment returns, some people might find that they have to delay retirement. Since the amount of money that you spend in a year on goods and services is a key component of the PSR, increasing those costs will lower your PSR.

What Can You Do?

TAKE ACTION

Inflation is a savings killer that cuts into a PSR unless action is taken to counter its impact. Inflation not only lowers spending levels, but it makes it more challenging to save money for retirement. As we prepare for retirement, we constantly adjust our PSR to meet retirement goals. If inflation impacts our PSR, we must make more money, buy fewer goods or services, or readjust portfolio diversification to increase potential returns. Otherwise, retirement might have to be delayed.

AUTOMATE SAVINGS

One mistake often made, particularly when investment returns are down, is reducing contributions to tax-deferred retirement savings accounts, such as IRAs. Maintaining or even increasing savings amounts can help maintain a consistent PSR month over month and prevent short-term PSR reductions from compounding over time. If your employer offers matching/partial matching contributions, ensure you are taking advantage of those options. Automate your contributions, which will help you prioritize your contributions and reduce splurging temptations. After all, compounding tax-free interest is the gift that keeps on giving.

TALK TO AN EXPERT

Additionally, this might be the ideal time to connect with your financial advisor, tax, or legal professional to make sure your investment portfolio is leveraging alternative investments that do not correlate with the stock market and are built to help you further mitigate inflation’s impact.

References:

1 U.S. Bureau of Economic Analysis, (2022), Personal Saving Rate [PSAVERT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PSAVERT

2 U.S. Bureau of Labor Statistics, (2022), 12- month percentage change in Consumer Price Index, January 1980-March 2022 [CHART], retrieved from https://www.bls.gov/opub/ted/2022/consumer-prices-up-8-5-percent-for-year-ended-march-2022.htm