As we get into the month of May, there are some self-directed IRA deadlines and responsibilities to have on your radar. These tasks are essential not only for IRS reporting but also for maintaining the good standing status of your IRA. You can find more upcoming IRA deadlines throughout 2022 by checking Your 2022 IRA Calendar.

Submit Fair Market Value Evaluations to STRATA by May 15

All IRA assets must be valued annually and at certain other times throughout the year to satisfy the administrative and IRS reporting requirements for IRAs. As an investor in alternative investments that do not have a readily available market value, you are responsible for obtaining an accurate valuation of your investment and providing it to your IRA custodian. You may also need to submit documentation to support the valuation, particularly for valuation changes of 50% or more.

STRATA Trust requires that IRA owners obtain the fair market valuation (or good faith estimate) once each year or prior to one of these events:

- A distribution of an asset in-kind (i.e., without liquidating)

- A conversion or recharacterization of an asset

- A major change in asset value

- The transfer of an asset to beneficiaries

You are required to engage a qualified independent third party to provide a valuation that complies with IRS Revenue Ruling 59-60. STRATA Trust can provide you with a list of several valuation companies, if needed

To submit your valuation, please submit a completed Fair Market Valuation Update Request form with the appropriate parts executed by the valuation agent.

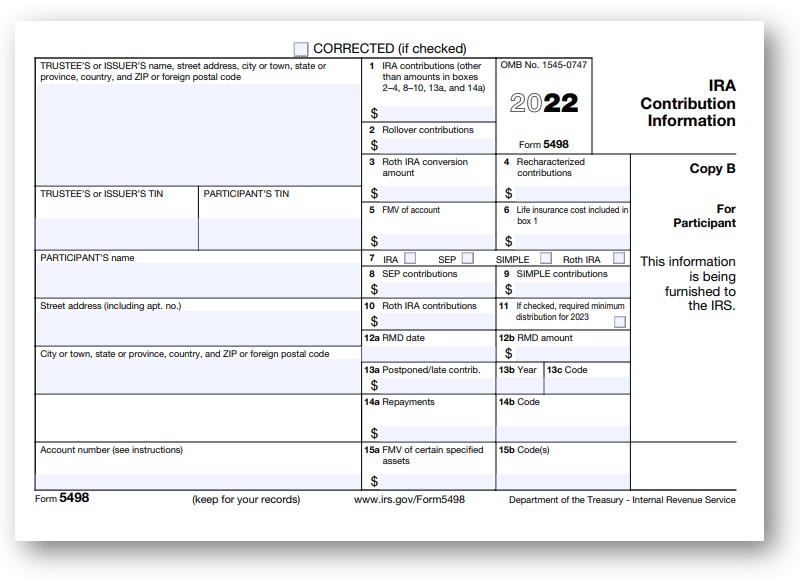

Watch For Your Copy of IRS Form 5498

Even if you have already filed your tax return for 2021, there is one more important tax document you’ll want to gather and save in your files. Each year, your IRA custodian must report to the IRS the value of your IRA contributions for the year. This information is reported on IRS Form 5498, IRA Contribution Information, filed with the IRS and sent to IRA owners by May 31 of the following calendar year. Form 5498 also reports the fair market value of the entire IRA as of December 31 of the prior year, as well as the value of certain types of alternative investments held within the IRA.

Form 5498 is an important record of your IRA contributions, including rollovers and recharacterizations. The IRS may use these forms to crosscheck against the IRA transaction reported on your individual federal tax return for the same year. For example, if you claimed on your tax return that an IRA distribution was not taxable because you rolled it over to another IRA within 60 days, the IRS should receive a Form 5498 for the IRA receiving the rollover that reports the dollar amount that you rolled over. Or, if you take a distribution from your Roth IRA and claim it is nontaxable because you are withdrawing basis, you’ll want to have the documentation supporting the amount you have contributed to your Roth IRA.

When you receive Form 5498 from your IRA custodian (either online or on paper, based on your communications preference), review the information and dollar amounts to make sure they match what you entered on your tax return. Any discrepancies could trigger an audit. Contact your IRA custodian if you have a question or believe there is an error on your Form 5498. If there is an error, your IRA custodian will issue a corrected form to both you and the IRS. Be sure to store your Form 5498 with your financial files to maintain a record of your IRA contributions.

Here’s a list of the information that you can find on a 2022 Form 5498.

| 2022 IRS Form 5498 Overview | |

| Box 1 | Traditional IRA contributions made for 2021 (and through April 18, 2022) |

| Box 2 | Rollover contributions deposited in 2021 (from another IRA or from an employer plan) |

| Box 3 | Roth IRA conversions from Traditional, SEP, or SIMPLE IRAs deposited in 2021 |

| Box 4 | Recharacterizations deposited in 2021 |

| Box 5 | Fair market value of all investments in the IRA as of December 31, 2021 |

| Box 7 | Checkbox to identify as Traditional, Roth, SEP, or SIMPLE IRA |

| Box 8 | SEP contributions deposited in 2021 (even if made for 2020 plan year) |

| Box 9 | SIMPLE IRA contributions deposited in 2021 (even if made for 2020 plan year) |

| Box 10 | Roth IRA contributions made for 2021 (and through April 18, 2022) |

| Box 11 | Checkbox if there is an RMD due for 2022 |

| Box 13a | Contribution made by a military servicemember or someone in a designated disaster area in 2021 for a prior year; or the amount of a late rollover contribution made in 2021, including late rollovers that are self-certified by the IRA owner, qualified plan loan offsets, or related to affected taxpayers in a federally declared disaster area |

| Box 13b | The year for which a postponed contribution was made |

| Box 13c | Code defining the reason for the postponed contribution (e.g., SC for self-certified rollovers past the 60-day timeframe) |

| Box 14a and 14b | Repayments of qualified reservist distributions, qualified disaster distributions, or qualified birth or adoption distributions and the applicable code (e.g., QR for repayment of a qualified reservist distribution) |

| Box 15a and 15b | Fair market value of certain hard-to-value investments as of December 31, 2021, and applicable IRS code (e.g., D = real estate) |

Questions? We Can Help.

More information on Form 5498 and Fair Market Value can be found on our FAQ page.

The IRS also provides further explanation of Form 5498 on their website.

For additional assistance, visit our client support page, where our self-directed IRA experts are ready to assist you.