What do Uber, Airbnb, Slack, SpaceX, and DoorDash all have in common? All of these companies were venture capital (VC)-backed organizations from the U.S. Most VC firms, traditional fund managers, and entrepreneurs do not correlate raising capital with IRAs – but many financial professionals utilize self-directed individual retirement accounts (SDIRAs) to tap into a much larger pool of experienced investors.

When inflation is high, costs for startup companies rise and they burn investment capital more quickly, which can slow down company growth as well as revenue. Investments in start-ups tend to track interest rates and inflation; during points of high rates and inflation, funding tends to slow down. Until interest rates and inflation stabilize, the fundraising environment is expected to remain difficult.

Portfolios with Alternatives Expected to Outperform in 2023

With public stock and bond markets in a tumultuous phase, interest in alternative investments look to be on the rise. Financial research firm Cerulli Associates found in a recent advisor survey that allocations to alternatives were up, amid market volatility. Polled advisors reported they were allocating an average of 14.5% of portfolios to alternatives, but that they expected to increase allocations to 17.5% in two years.1

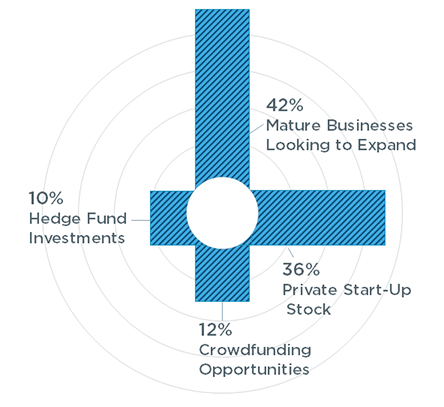

In STRATA Trust Company’s (“STRATA”) 2022 Investor Survey Report, respondents reported that commodities, private equity, and real estate are the most commonly held SDIRA investments.2 Additionally, when we asked how they primarily use their SDIRA account in the alternative marketplace, 42% of those reporting said they favor mature businesses looking to expand, while 36% said they prefer private start-up stock.

What Type of Alternative Investment Opportunities

Do You Typically Like to Focus On?

Source: 2022 SDIRA Investor Survey Report – STRATA Trust Company

Investors that hold alternative investments have confidence in their 2023 portfolio performance. “Many foresee 2023 to be a big year for alternative investments rather than traditional public equities. In fact, 67% of institutional investors said they expect a portfolio including 20% alternatives to outperform a traditional 60/40 investment mix.” 3

As of the end of 2022, IRAs in the United States held $11.5 trillion in assets. The SEC and the Retirement Industry Trust Association (RITA) estimate that 2%-5% of IRA assets are in SDIRAs4 – this equates to between $280 and $700 billion of investible assets. SDIRAs are a very attractive investment vehicle because investors can:

- Choose to pay taxes now or in the future

- Grow investments in a tax-advantaged environment

- Diversify holdings away from publicly-traded markets

- Employ personal value investing tactics

- Leverage specialized industry knowledge

- Transfer ownership of IRAs directly to beneficiaries outside of probate

Raising capital through an SDIRA can be simple and beneficial for both the organization and the investor.

Investor Risk

Finding the next Uber might be a unicorn in the VC world, but they do exist. With any investment comes risk, and investing in new companies through an SDIRA is certainly not risk-free. Many startups fail, and private funding can be complex and requires an elevated level of investment knowledge. Investors should be comfortable with assessing the potential risks and returns of investments.

If VC investing or other private equity investments have been on your radar, understanding what stage the organization is in and what the investor exit strategy is can help align your personal risk vs. reward targets with your investing goals. It is recommended that SDIRA investors use the services of a financial advisor or another trusted financial professional to help navigate alternative investments.

Getting Started

If you are looking to raise funds during this challenging time, giving investors the option to invest through a self-directed IRA (SDIRA) can be smart for you and your investors. Investors can leverage the power of tax-advantaged growth in their retirement account while you can develop a competitive edge when it comes to capital raising. Contact our self-directed IRA experts today to learn more.

1Cerulli Associates. Alternative Investments in 2022: Capitalizing on Markets in Turmoil. (July 19, 2022)

2 STRATA Trust Company, 2022 Self-Directed IRA Investor Survey Report.

3 Pallotta, Chris. “Three Alternative Investment Predictions for the Rest of 2023″. (March 10, 2023)

4 Hagen, Patrick. “Why Self-Directed Individual Retirement Accounts Make So Much Sense“.(March 9, 2021)