Note: FMV reporting to STRATA has been extended to July 31, 2020.

Fair market value: What is it?

IRA custodians, like STRATA Trust Company, are required by federal law to report the fair market value (“FMV”) of each retirement account it administers to the Internal Revenue Service each year. To properly complete these functions, IRA custodians must request valuations for each investment owned by the IRA.

In most cases, STRATA will receive the FMV directly from the investment issuer, as is the case on most private equity investments, private debt, futures and some real estate investments. If an investment issuer is unwilling or unable to provide an updated FMV to the IRA custodian on an annual basis, you as the IRA owner are ultimately responsible for obtaining and providing an updated FMV from an independent third party to the IRA custodian. Your investment sponsor may have already received a letter from us requesting an updated FMV.

Appraising alternative assets

Accurately providing a value for certain types of alternative investments with no readily ascertainable value, such as private equity, real estate, or business ventures, can be challenging. For real estate, it’s fairly easy since the IRA owner can obtain an updated appraisal or broker’s opinion of the value each year. For other alternative investments, keep in mind that the owner of the IRA cannot determine the FMV of an alternative investment for the purpose of reporting to the IRS. That means, in the absence of an FMV provided by the investment issuer, the owner or the financial advisor will have to obtain the FMV from an independent third party who specializes in appraising alternative assets.

For real estate, an appraisal should be performed by a certified property appraiser, and a broker’s price opinion should be performed by a real estate professional using STRATA’s Real Estate Valuation form.

FMV reporting deadline extended to July 31, 2020

Typically, the FMV would be due to your IRA custodian by May 15th of each year. However, this year’s deadline for providing FMV valuations to STRATA has been extended to July 31, 2020 due to the Coronavirus pandemic. If the FMV will not be available until after July 31st, simply let us know in writing of the expected date it will be available so we can suspend notifications until that date.

Form 5498

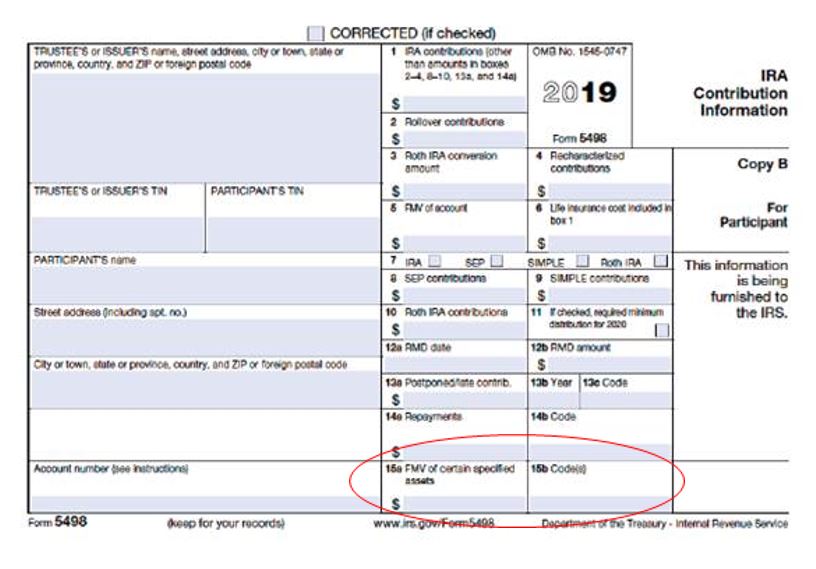

These FMVs are then used by STRATA to report the value of the IRA to the IRS on Form 5498, and part of Form 5498 requires the IRA custodian to report whether the IRA holds any “hard to value assets” like alternative investments. See below for an example of how they would appear on Form 5498.

Frequently Asked Questions

Below are some of the most recent questions we’ve received regarding Fair Market Value Reporting. If you have questions about FMV reporting, contact our dedicated Client Service team at 866-928-9394.

Can I provide a tax appraisal statement for the property?

Unfortunately, STRATA cannot accept tax appraisal values since they are not always indicative of the actual value of a property. Tax values can vary widely from the market value, so the values from an appraisal or a broker’s price opinion provide more accurate values for our required reporting to the IRS each year. While other unregulated third-party administrators might accept tax appraisal values, STRATA is a regulated trust company and does not accept them.

What if I believe an investment is worthless or out of business?

STRATA will need supporting documentation to change a value to zero. Examples of this include:

• A third-party appraisal

• A written explanation from the entity signed by an officer or managing member

• Documentation from a court-appointed receiver regarding the value

• Bankruptcy paperwork (Chapter 7 only)

• Articles of dissolution filed with the state

For more information, view our Fair Market Valuation Update Request instructions and form or view more of our Fair Market Value Frequently Asked Questions.

If you have questions about valuation or alternative investment options, please contact us at [email protected].

Disclaimer: The information provided herein does not, and is not intended to, constitute personalized financial or legal advice. The contents of the article are for general informational purposes only and should not be relied or acted upon without specific professional legal or financial advice, based upon an individual’s situation.