IRS Update: Additional Tax Relief Available

The IRS has recently issued additional tax relief notices to help aid those impacted by recent disaster situations. The IRS notices announce fuel penalty relief and a variety of extensions...

Have You Put Too Much In Your IRA?

The tax laws don’t limit how much your IRA investments can grow each year or how much you can roll over into your IRA from another tax-qualified account, but they...

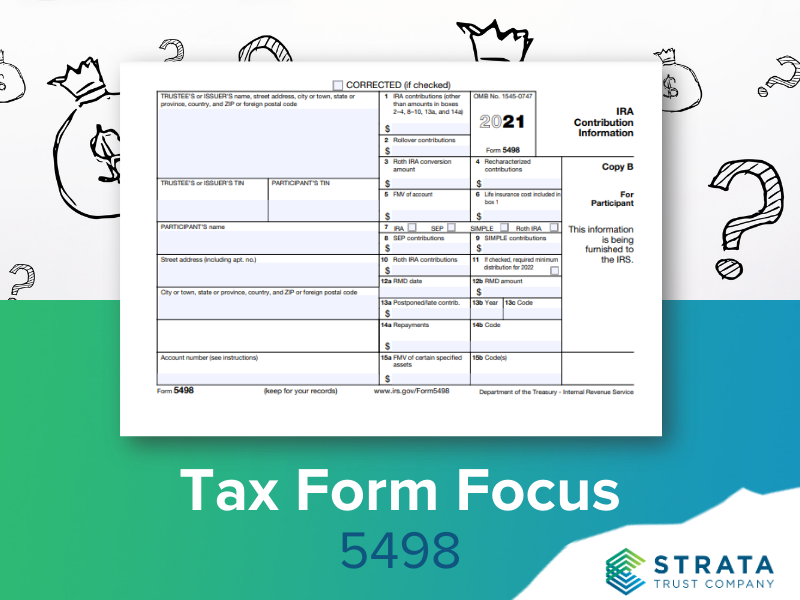

Tax Form Focus: IRS Form 5498

If you own an IRA (including an inherited IRA), you should receive an IRS Form 5498 every year that a reportable event took place. IRA custodians use this form to report...

Update: 2020 IRA Exemptions and Exceptions

With high hopes that 2021 will bring fewer last-minute, emergency changes to tax and IRA-related rules than we saw in 2020, now may be a good time to clear up...

5 Retirement-Smart Ways to Use Your Tax Refund

If you receive a tax refund this year consider putting that money to work for you instead of spending it. You can save and/or invest that money for your future...

What Tax-Free Growth Looks Like

Whether you’re saving for retirement or another financial goal, it’s important to consider how the tax benefits available with different types of accounts will help you reach your financial objectives....