Self-directed IRAs (SDIRAs) come with tax benefits – it’s up to the investor to understand the tax reporting requirements to claim those benefits. During tax season, one of the most important tax forms you may receive is an IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Form 1099-R reports assets leaving an SDIRA and may increase the amount of taxable income you need to claim on your tax return.

If you withdrew $10 or more from your SDIRA in 2022, your SDIRA custodian will send you a Form 1099-R by January 31, 2023. This includes amounts that you recharacterized, converted, or rolled over, but does not include direct IRA-to-IRA transfers because transfers are not taxable and are not reported to the IRS.

Your SDIRA custodian must also file your Form 1099-R with the IRS. The IRS will match your Form 1099-R to the taxable income and tax liability you report on your tax return, so you want to be sure your form information is accurate and that you correctly claim taxable income – or explain why an SDIRA withdrawal is not taxable – on your tax return.

IRA Taxation Refresher

To understand the type of information contained on IRS Form 1099-R, you need to understand the general IRA taxation rules:

- Assets coming out of a Traditional IRA are generally taxable to you but may be only partially taxable if you made nondeductible contributions or rolled over after-tax amounts to any of your Traditional IRAs and have not yet distributed all those assets.

- Assets coming out of a Roth IRA are tax free if you meet the requirements for a qualified distribution. If a Roth IRA distribution is not qualified, the portion of the distribution representing contributions will be tax-free, and the portion representing investment earnings will be taxable.

- The taxable portion of any IRA distribution is subject to an additional 10% early distribution tax if you are not yet age 59½ and do not meet one of the IRS’s exceptions to the additional tax. A list of exceptions can be found in our article, How to Avoid the Early Distribution Tax.

Key Information on Form 1099-R

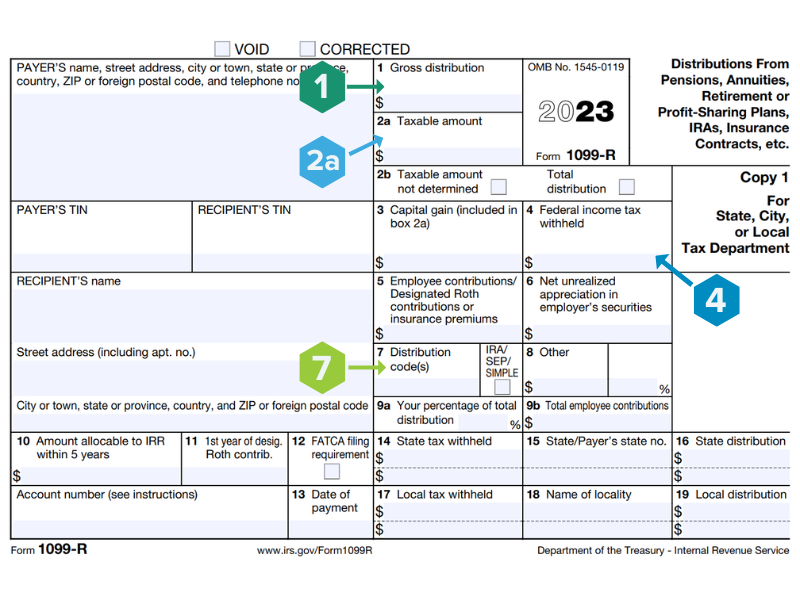

The IRS uses key information on Form 1099-R to identify whether your IRA distribution is taxable income and whether it is subject to the 10% early distribution tax. If you receive a 2022 Form 1099-R, you will need to include certain information from that form on your 2022 income tax return:

Box 1 – Gross distribution amount – Reports the total amount withdrawn from the IRA before any federal or state income taxes were withheld. For a Traditional IRA distribution, this amount is typically taxable.

Box 2a – Taxable portion – Reports the amount of the distribution that is taxable to the recipient. However, because IRA custodians cannot track basis in an IRA, custodians cannot report the taxable portion of IRA distributions. This box may either show the same amount as Box 1 or it may be blank. If Box 2a shows a dollar amount different from Box 1 and you timely removed an IRA excess contribution, the amount in Box 2a reports the taxable earnings removed with the excess.

Box 4 – Federal income tax withheld – Reports the amount withheld and sent to the IRS, if any, as a prepayment of tax. Include this amount on your income tax return as tax withheld, and if box 4 shows a dollar amount, attach Copy B to your return.

Box 7 – Distribution code – Alerts the IRS as to whether a distribution may be taxable or subject to the 10% early distribution tax. For some types of distributions, more than one code may apply. For example, codes 1 and 8 report the removal of an excess contribution from a Traditional IRA by an IRA owner younger than age 59½. Because the codes used on Form 1099-R alert the IRS to potential tax liability, it’s important that the correct codes are shown on Form 1099-R, or that you can explain the correct taxation on your tax return.

Here are the most common distribution codes for self-directed IRAs and what they tell the IRS:

| Code | What It Means | What It Says About Taxation |

| 1 | Traditional IRA owner was younger than age 59½ at time of distribution and 10% tax applies, OR there is no code for the exception the IRA owner meets to the 10% tax (e.g., higher education expenses). | The 10 % early distribution tax may apply |

| 2 | Traditional IRA owner was younger than age 59½ at time of distribution, but it was a direct conversion to a Roth IRA, an IRS levy, or a substantially equal periodic payment. | Exception to 10% early distribution tax |

| 4 | Beneficiary takes a distribution after the death of the Traditional IRA owner | Exception to 10% early distribution tax |

| 7 | IRA owner was age 59½ or older at the time of distribution | No 10% early distribution tax |

| 8 | IRA owner timely distributed an IRA excess contribution made in 2022 | Earnings listed in Box 2a are taxable for 2022 |

| P | IRA owner timely distributed an IRA excess contribution made in 2021 | Earnings listed in Box 2a are taxable for 2021 |

| J | Roth IRA owner was younger than 59½ at the time of distribution and Code Q or T does not apply | The 10% early distribution tax may apply to a portion of the distribution |

| Q | Roth IRA owner met the requirements for a qualified distribution | No tax and no 10% early distribution tax |

| T | Roth IRA owner was older than 59½, deceased, or disabled, but IRA custodian doesn’t know if 5-year rule has been satisfied for a qualified distribution | May be taxable, but not eligible for the 10% early distribution tax |

Next Steps

When you receive Form 1099-R in the mail from your SDIRA custodian, make sure all the information is correct, from your name and address to the dollar amounts and the distribution code(s). If you believe there is an error, contact your STRATA SDIRA custodian as soon as possible to correct the form. If you have questions about your STRATA Form 1099-R, please contact our self-directed IRA experts, who are ready to help.